Analysis of Sprockets Market Covering 30+ Countries Including Analysis of US, Canada, UK, Germany, France, Nordics, GCC countries, Japan, Korea and many more

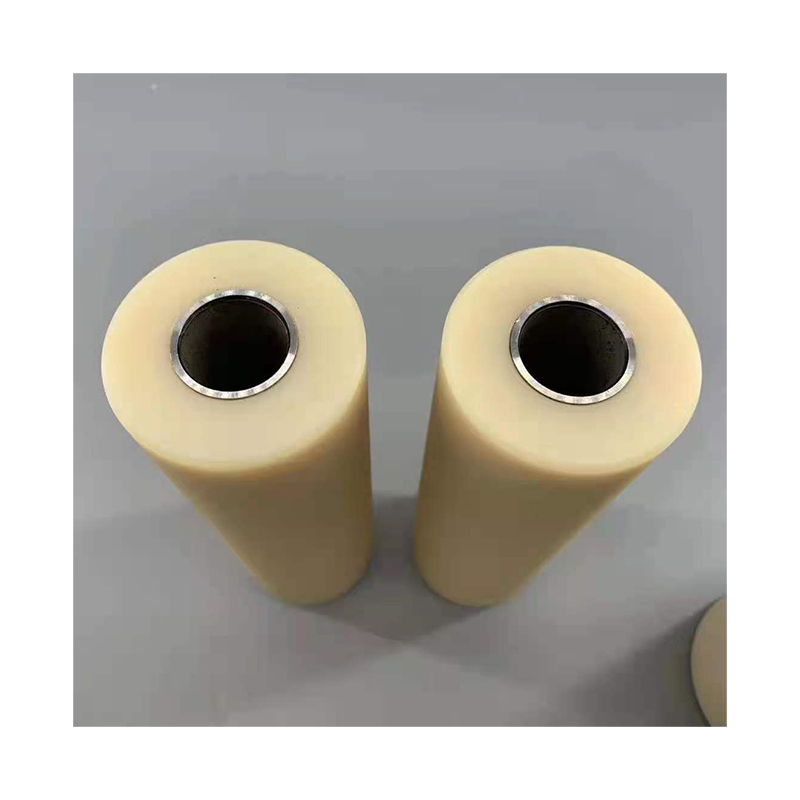

The global sprockets market is forecasted to increase from a valuation of US$ 4.99 billion in 2023 to US$ 9.76 billion by 2033. Worldwide sales of sprockets are expected to increase at a noteworthy CAGR of 6.9% from 2023 to 2033. Cast Nylon Sheet

A sprocket is a wheel that has teeth or cogs that connect to a chain, track, or other material that has been pierced or dented. Any wheel with radial projections that contact a chain traveling over it is referred to as a 'sprocket'.

In machines such as bicycles, motorcycles, tracked vehicles, and other vehicles, sprockets are used to either transmit linear motion to a track, tape, or other surface or to transmit rotational motion between two shafts when gears are ineffective. Sprockets come in a variety of styles and often lack a rim.

To keep the timing belt centered, certain sprockets used with timing belts feature flanges. When slippage is unacceptable, sprockets and chains are also employed to transfer power from one shaft to another. They can operate at high speeds, and some types of chains are made to be noiseless even at these speeds.

Some types of sprockets are designed to be noiseless even at high speeds and can operate at very high speeds. They should be regularly checked for wear and tear. As a result, they are regarded as a very reliable and cost-effective drive system for continuous drive applications because of their distinctive qualities, such as great shock absorption and minimal torque loads.

Sprockets are an essential part of a machine and are a prerequisite for power transmission and motion in end-use industries such as automotive, building and construction, food & beverages, glass & plastic, textiles, and many more. Over the last few years, global investments have increased substantially, indicating the growth of machines generating power through chain drives and, as such, accelerating relative demand for sprockets.

Don't Need a Global Report?

save 40%! on Country & Region specific reports

“Usage Increasing Due to Growing Sales of Passenger Cars and Two-wheelers”

Increased use of bicycles and motorcycles has led to a higher potential demand for sprockets globally. An elevation in the graph of bicycles was recorded due to the boom in the health-conscious population. Bicycles suitable for family use, neighborhood rides, short-distance rides, and fun strolls have experienced massive growth.

The aforementioned factors will facilitate numerous growth opportunities for sprocket manufacturers over the coming years. With mounting sales of passenger cars and two-wheelers, demand for sprockets in the automotive industry is expected to rise over the coming years.

“Increase in Safety Rules by Several Governments”

Safety rules set by governments for construction machinery, automotive, manufacturing, and the food and beverage industries play a huge role in driving the sales of sprockets. Prolonged use of chains and sprockets together not only causes wear on the machine but also decreases its efficiency.

Government safety standards insist on changing worn machine parts on a timely basis. This not only ensures the safety of the user but also increases the longevity of the machine. The increasing need for conveyor systems in sectors such as electronics and automotive is fueling market expansion.

Constant wearing of chains and sprockets also generates noise in the whole appliance, causing discomfort to the user and also adding to the level of noise pollution. Furthermore, OSHA and vehicle safety norms take care of related problems and impose stringent actions against defaulters. All this is leading to heightened demand for sprockets across regions.

“Rapid Growth of Material Handling Industry”

Construction, mining, oil & gas, and machine tools are just a few of the industries that aim to embrace varied material handling equipment that includes sprockets as a key component. Sprocket's essential characteristics, such as superior durability even under difficult working circumstances, noiseless operation, high load capacity, and low vibration, make their use in material handling equipment profitable.

The Industrial Internet of Things (IIoT), which refers to the expanding connection of technology and equipment, is expected to make material handling smarter over the coming years. By collaborating and networking with their clients, smart manufacturing companies are concentrating on maximizing both their productivity and safety.

The overall production floor is evolving to accommodate increasingly adaptable business requirements and predictive planning, from picking and sorting systems to conveying systems.

“Rise in Air Contamination and Tailpipe Emissions Caused by Vehicles”

Market expansion is hampered by a rise in air contamination and tailpipe emissions caused by vehicles. One of the primary elements expected to impede the growth of the worldwide market is the requirement for regular maintenance.

More Insights, Lesser Cost (-50% off)

Insights on import/export production, pricing analysis, and more – Only @ Fact.MR

“New Companies Concentrating on Introducing Advanced and High-quality Sprockets”

The most important trend to have gained customer’s attention is the availability of customized sprockets. New entrants are improving their laser-cutting equipment to lower the price of plate tooling. Additionally, there has been a notable reduction in downtime and rejection levels as a result of this. New companies are focusing on introducing advanced and high-quality sprockets.

What is Propelling the Demand for Sprockets in the United States?

“Increase in Infrastructural Projects across the Country”

The U.S. market is poised to experience a moderate growth rate due to an increase in infrastructural projects. Market growth is anticipated to be fueled by a strong foundation of automotive component production and rapid industrialization throughout the projection period.

“Growing Investments in Automation Technologies”

Presence of top sprocket manufacturers and increased demand for conveyor sprockets from several industries are both factors contributing to market growth. The expanding automotive sector and an increase in investments in automation technologies are supporting market expansion.

“Easy Availability of Raw Materials in the Country”

Rise in vehicle production and sales and soaring need for sprockets for various industrial applications are all factors contributing to market growth. The easy availability of raw materials and low-cost labor is expected to boost market revenue in the country.

“Market Will Benefit from Rapid Expansion of Construction Industry”

Growing consumer spending on automobiles and rapid growth of the construction industry are the key factors supporting market expansion. The market is anticipated to grow as a result of the government’s support to push the domestic manufacturing capabilities in chain sprockets production.

Competitive landscape highlights only certain players Complete list available upon request

Which End Use Accounts for the Most Sales of Sprockets?

“Increasing Demand for Motorcycles Due to High Traffic Congestion Driving Adoption of Sprockets”

Based on end use, the market is classified into bicycles, motorcycles, building & construction, food & beverages, glass & plastic, textiles, agricultural equipment, and others.

Sprockets are one of the vital components of the motorcycle transmission system. The expansion of the sprocket industry has also been aided by the increased demand for sports motorcycles caused by the increasing sports competition. Increasing demand for motorcycles as a result of high traffic congestion is anticipated to fuel the adoption of sprockets.

One of the main factors anticipated to boost market expansion is an increase in demand for appealing and fashionable motorcycles. Manufacturers are putting a lot of effort into creating traditional bikes with sportier styling, superior fuel economy, and bigger displacement engines, which will generate many opportunities for sprocket manufacturers throughout the projection period.

Key market players are focusing on operating through indirect channel structures, such as selling through certified and recognized dealers, to ensure a smooth flow of their supply chain management and rapid delivery to their users. They are concentrating on new developments, product standards, quality control, and collaborations to strengthen their market position.

Leading companies are also renovating their products for specific industries, such as the use of anti-corrosive technology in the food and beverage industry. These trends help manufacturers gain an edge over competitors who don’t evolve with time.

By Pitch : Standard Below 1/2 Inches 1/2 to 1 Inches 1.1 to 1.5 Inches 1.6 to 2 Inches Above 2 Inches Customized By Material : Steel Stainless Steel Carbon Steel Cast Iron Thermoplastics Others By Bore : Plain Taper Lock By Strand : Simplex Duplex Triplex By Application : Conveyors Rotor Rollers Other Drives By End Use : Bicycles Motorcycles Building & Construction Food & Beverages Glass & Plastic Textiles Agricultural Equipment Others By Region : North America Europe Asia Pacific Latin America Middle East & Africa

Don't Need a Global Report?

save 40%! on Country & Region specific reports

TABLE 01: Global Market Value (US$ Mn), 2018 to 2022

TABLE 02: Global Market Value (US$ Mn), 2023 to 2033

TABLE 03: Global Market Value (US$ Mn) and Y-o-Y, 2018 to 2033

TABLE 04: Global Pitch Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 05: Global Pitch Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 06: Global Pitch Segment Market Share, By Region 2018 to 2022

TABLE 07: Global Pitch Segment Market Share, By Region 2023 to 2033

TABLE 08: Global Pitch Segment Y-o-Y, By Region 2018 to 2033

TABLE 09: Global Material Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 10: Global Material Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 11: Global Material Segment Market Share, By Region 2018 to 2022

TABLE 12: Global Material Segment Market Share, By Region 2023 to 2033

TABLE 13: Global Material Segment Y-o-Y, By Region 2018 to 2033

TABLE 14: Global Bore Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 15: Global Bore Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 16: Global Bore Segment Market Share, By Region 2018 to 2022

TABLE 17: Global Bore Segment Market Share, By Region 2023 to 2033

TABLE 18: Global Bore Segment Y-o-Y, By Region 2018 to 2033

TABLE 19: Global Strand Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 20: Global Strand Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 21: Global Strand Segment Market Share, By Region 2018 to 2022

TABLE 22: Global Strand Segment Market Share, By Region 2023 to 2033

TABLE 23: Global Strand Segment Y-o-Y, By Region 2018 to 2033

TABLE 24: Global Strand Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 25: Global Strand Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 26: Global Strand Segment Market Share, By Region 2018 to 2022

TABLE 27: Global Strand Segment Market Share, By Region 2023 to 2033

TABLE 28: Global Strand Segment Y-o-Y, By Region 2018 to 2033

TABLE 29: Global Application Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 30: Global Application Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 31: Global Application Segment Market Share, By Region 2018 to 2022

TABLE 32: Global Application Segment Market Share, By Region 2023 to 2033

TABLE 33: Global Application Segment Y-o-Y, By Region 2018 to 2033

TABLE 34: Global Application Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 35: Global Application Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 36: Global Application Segment Market Share, By Region 2018 to 2022

TABLE 37: Global Application Segment Market Share, By Region 2023 to 2033

TABLE 38: Global Application Segment Y-o-Y, By Region 2018 to 2033

TABLE 39: Global End Use Verticals Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 40: Global End Use Verticals Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 41: Global End Use Verticals Segment Market Share, By Region 2018 to 2022

TABLE 42: Global End Use Verticals Segment Market Share, By Region 2023 to 2033

TABLE 43: Global End Use Verticals Segment Y-o-Y, By Region 2018 to 2033

TABLE 44: Global Standard Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 45: Global Standard Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 46: Global Standard Segment Market Share, By Region 2018 to 2022

TABLE 47: Global Standard Segment Market Share, By Region 2023 to 2033

TABLE 48: Global Standard Segment Y-o-Y, By Region 2018 to 2033

TABLE 49: Global Pitch Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 50: Global Pitch Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 51: Global Pitch Segment Market Share, By Region 2018 to 2022

TABLE 52: Global Pitch Segment Market Share, By Region 2023 to 2033

TABLE 53: Global Pitch Segment Y-o-Y, By Region 2018 to 2033

TABLE 54: Global Bore Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 55: Global Bore Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 56: Global Bore Segment Market Share, By Region 2018 to 2022

TABLE 57: Global Bore Segment Market Share, By Region 2023 to 2033

TABLE 58: Global Bore Segment Y-o-Y, By Region 2018 to 2033

TABLE 59: Global Bore Segment Value (US$ Mn), By Region 2018 to 2022

TABLE 60: Global Bore Segment Value (US$ Mn), By Region 2023 to 2033

TABLE 61: Global Bore Segment Market Share, By Region 2018 to 2022

TABLE 62: Global Bore Segment Market Share, By Region 2023 to 2033

TABLE 63: Global Bore Segment Y-o-Y, By Region 2018 to 2033

TABLE 64: North America Market Value (US$ Mn), By Pitch 2018 to 2022

TABLE 65: North America Market Value (US$ Mn), By Pitch 2023 to 2033

TABLE 66: North America Market Value (US$ Mn), By Material 2018 to 2022

TABLE 67: North America Market Value (US$ Mn), By Material 2023 to 2033

TABLE 68: North America Market Value (US$ Mn), By Distribution Channel 2018 to 2022

TABLE 69: North America Market Value (US$ Mn), By Distribution Channel 2023 to 2033

TABLE 70: North America Market Value (US$ Mn), By Strand 2018 to 2022

TABLE 71: North America Market Value (US$ Mn), By Strand 2023 to 2033

TABLE 72: Latin America Market Value (US$ Mn), By Pitch 2018 to 2022

TABLE 73: Latin America Market Value (US$ Mn), By Pitch 2023 to 2033

TABLE 74: Latin America Market Value (US$ Mn), By Material 2018 to 2022

TABLE 75: Latin America Market Value (US$ Mn), By Material 2023 to 2033

TABLE 76: Latin America Market Value (US$ Mn), By Distribution Channel 2018 to 2022

TABLE 77: Latin America Market Value (US$ Mn), By Distribution Channel 2023 to 2033

TABLE 78: Latin America Market Value (US$ Mn), By Strand 2018 to 2022

TABLE 79: Latin America Market Value (US$ Mn), By Strand 2023 to 2033

TABLE 80: Europe Market Value (US$ Mn), By Pitch 2018 to 2022

TABLE 81: Europe Market Value (US$ Mn), By Pitch 2023 to 2033

TABLE 82: Europe Market Value (US$ Mn), By Material 2018 to 2022

TABLE 83: Europe Market Value (US$ Mn), By Material 2023 to 2033

TABLE 84: Europe Market Value (US$ Mn), By Distribution Channel 2018 to 2022

TABLE 85: Europe Market Value (US$ Mn), By Distribution Channel 2023 to 2033

TABLE 86: Europe Market Value (US$ Mn), By Strand 2018 to 2022

TABLE 87: Europe Market Value (US$ Mn), By Strand 2023 to 2033

TABLE 88: East Asia Market Value (US$ Mn), By Pitch 2018 to 2022

TABLE 89: East Asia Market Value (US$ Mn), By Pitch 2023 to 2033

TABLE 90: East Asia Market Value (US$ Mn), By Material 2018 to 2022

TABLE 91: East Asia Market Value (US$ Mn), By Material 2023 to 2033

TABLE 92: East Asia Market Value (US$ Mn), By Distribution Channel 2018 to 2022

TABLE 93: East Asia Market Value (US$ Mn), By Distribution Channel 2023 to 2033

TABLE 94: East Asia Market Value (US$ Mn), By Strand 2018 to 2022

TABLE 95: East Asia Market Value (US$ Mn), By Strand 2023 to 2033

TABLE 96: South Asia & Oceania Market Value (US$ Mn), By Pitch 2018 to 2022

TABLE 97: South Asia & Oceania Market Value (US$ Mn), By Pitch 2023 to 2033

TABLE 98: South Asia & Oceania Market Value (US$ Mn), By Material 2018 to 2022

TABLE 99: South Asia & Oceania Market Value (US$ Mn), By Material 2023 to 2033

TABLE 100: South Asia & Oceania Market Value (US$ Mn), By Distribution Channel 2018 to 2022

TABLE 101: South Asia & Oceania Market Value (US$ Mn), By Distribution Channel 2023 to 2033

TABLE 102: South Asia & Oceania Market Value (US$ Mn), By Strand 2018 to 2022

TABLE 103: South Asia & Oceania Market Value (US$ Mn), By Strand 2023 to 2033

TABLE 104: MEA Market Value (US$ Mn), By Pitch 2018 to 2022

TABLE 105: MEA Market Value (US$ Mn), By Pitch 2023 to 2033

TABLE 106: MEA Market Value (US$ Mn), By Material 2018 to 2022

TABLE 107: MEA Market Value (US$ Mn), By Material 2023 to 2033

TABLE 108: MEA Market Value (US$ Mn), By Distribution Channel 2018 to 2022

TABLE 109: MEA Market Value (US$ Mn), By Distribution Channel 2023 to 2033

TABLE 110: MEA Market Value (US$ Mn), By Strand 2018 to 2022

TABLE 111: MEA Market Value (US$ Mn), By Strand 2023 to 2033

More Insights, Lesser Cost (-50% off)

Insights on import/export production, pricing analysis, and more – Only @ Fact.MR

FIG. 01: Global Market Value (US$ Mn), 2018 to 2022

FIG. 02: Global Market Value (US$ Mn) Forecast, 2023 to 2033

FIG. 03: Global Market Value (US$ Mn) and Y-o-Y, 2018 to 2033

FIG. 04: Global Pitch Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 05: Global Pitch Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 06: Global Pitch Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 07: Global Material Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 08: Global Material Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 09: Global Material Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 10: Global Bore Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 11: Global Bore Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 12: Global Bore Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 13: Global Strand Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 14: Global Strand Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 15: Global Strand Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 16: Global Strand Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 17: Global Strand Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 18: Global Strand Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 19: Global Application Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 20: Global Application Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 21: Global Application Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 22: Global Application Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 23: Global Application Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 24: Global Application Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 25: Global End Use Verticals Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 26: Global End Use Verticals Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 27: Global End Use Verticals Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 28: Global Standard Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 29: Global Standard Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 30: Global Standard Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 31: Global Pitch Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 32: Global Pitch Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 33: Global Pitch Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 34: Global Bore Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 35: Global Bore Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 36: Global Bore Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 37: Global Bore Segment Market Value (US$ Mn) By Region, 2018 to 2022

FIG. 38: Global Bore Segment Market Value (US$ Mn) By Region, 2023 to 2033

FIG. 39: Global Bore Segment Y-o-Y Growth Rate, By Region, 2018 to 2033

FIG. 40: North America Market Value (US$ Mn), By Pitch 2018 to 2022

FIG. 41: North America Market Value (US$ Mn), By Pitch 2023 to 2033

FIG. 42: North America Market Value (US$ Mn), By Material 2018 to 2022

FIG. 43: North America Market Value (US$ Mn), By Material 2023 to 2033

FIG. 44: North America Market Value (US$ Mn), By Distribution Channel 2018 to 2022

FIG. 45: North America Market Value (US$ Mn), By Distribution Channel 2023 to 2033

FIG. 46: North America Market Value (US$ Mn), By Strand 2018 to 2022

FIG. 47: North America Market Value (US$ Mn), By Strand 2023 to 2033

FIG. 48: Latin America Market Value (US$ Mn), By Pitch 2018 to 2022

FIG. 49: Latin America Market Value (US$ Mn), By Pitch 2023 to 2033

FIG. 50: Latin America Market Value (US$ Mn), By Material 2018 to 2022

FIG. 51: Latin America Market Value (US$ Mn), By Material 2023 to 2033

FIG. 52: Latin America Market Value (US$ Mn), By Distribution Channel 2018 to 2022

FIG. 53: Latin America Market Value (US$ Mn), By Distribution Channel 2023 to 2033

FIG. 54: Latin America Market Value (US$ Mn), By Strand 2018 to 2022

FIG. 55: Latin America Market Value (US$ Mn), By Strand 2023 to 2033

FIG. 56: Europe Market Value (US$ Mn), By Pitch 2018 to 2022

FIG. 57: Europe Market Value (US$ Mn), By Pitch 2023 to 2033

FIG. 58: Europe Market Value (US$ Mn), By Material 2018 to 2022

FIG. 59: Europe Market Value (US$ Mn), By Material 2023 to 2033

FIG. 60: Europe Market Value (US$ Mn), By Distribution Channel 2018 to 2022

FIG. 61: Europe Market Value (US$ Mn), By Distribution Channel 2023 to 2033

FIG. 62: Europe Market Value (US$ Mn), By Strand 2018 to 2022

FIG. 63: Europe Market Value (US$ Mn), By Strand 2023 to 2033

FIG. 64: East Asia Market Value (US$ Mn), By Pitch 2018 to 2022

FIG. 65: East Asia Market Value (US$ Mn), By Pitch 2023 to 2033

FIG. 66: East Asia Market Value (US$ Mn), By Material 2018 to 2022

FIG. 67: East Asia Market Value (US$ Mn), By Material 2023 to 2033

FIG. 68: East Asia Market Value (US$ Mn), By Distribution Channel 2018 to 2022

FIG. 69: East Asia Market Value (US$ Mn), By Distribution Channel 2023 to 2033

FIG. 70: East Asia Market Value (US$ Mn), By Strand 2018 to 2022

FIG. 71: East Asia Market Value (US$ Mn), By Strand 2023 to 2033

FIG. 72: South Asia & Oceania Market Value (US$ Mn), By Pitch 2018 to 2022

FIG. 73: South Asia & Oceania Market Value (US$ Mn), By Pitch 2023 to 2033

FIG. 74: South Asia & Oceania Market Value (US$ Mn), By Material 2018 to 2022

FIG. 75: South Asia & Oceania Market Value (US$ Mn), By Material 2023 to 2033

FIG. 76: South Asia & Oceania Market Value (US$ Mn), By Distribution Channel 2018 to 2022

FIG. 77: South Asia & Oceania Market Value (US$ Mn), By Distribution Channel 2023 to 2033

FIG. 78: South Asia & Oceania Market Value (US$ Mn), By Strand 2018 to 2022

FIG. 79: South Asia & Oceania Market Value (US$ Mn), By Strand 2023 to 2033

FIG. 80: MEA Market Value (US$ Mn), By Pitch 2018 to 2022

FIG. 81: MEA Market Value (US$ Mn), By Pitch 2023 to 2033

FIG. 82: MEA Market Value (US$ Mn), By Material 2018 to 2022

FIG. 83: MEA Market Value (US$ Mn), By Material 2023 to 2033

FIG. 84: MEA Market Value (US$ Mn), By Distribution Channel 2018 to 2022

FIG. 85: MEA Market Value (US$ Mn), By Distribution Channel 2023 to 2033

FIG. 86: MEA Market Value (US$ Mn), By Strand 2018 to 2022

FIG. 87: MEA Market Value (US$ Mn), By Strand 2023 to 2033

Competitive landscape highlights only certain players Complete list available upon request

Get insights that lead to new growth opportunities

Get A Special pricing for start-ups and universities

An Adaptive Approach to Modern-day Research Needs

The global sprockets market is valued at US$ 4.99 billion in 2023.

Worldwide sales of sprockets are set to reach US$ 9.76 billion by 2033.

Global demand for sprockets is predicted to rise at a CAGR of 6.9% through 2033.

The market for sprockets in China is expected to reach US$ 2 billion by 2033.

The market in Japan is set to evolve at a CAGR of 5.6% from 2023 to 2033.

11140 Rockville Pike, Suite 400, Rockville, MD 20852, United States Tel: +1 (628) 251-1583 | sales@factmr.com

Suite 9884, 27 Upper Pembroke Street, Dublin 2, Ireland Tel: +353-1-4434-232 (D) | sales@factmr.com

Copyright © Fact.MR All Rights Reserved

An initiative of Eminent Research and Advisory Services

Your personal details are safe with us. Privacy Policy*

U Groove Nylon Pulley Your personal details are safe with us. Privacy Policy*